INDmoney: Stocks, Mutual Fund

INDmoney: Stocks, Mutual Fund Summary

INDmoney: Stocks, Mutual Fund is a mobile iOS app in Finance by INDMONEY TECH PRIVATE LIMITED. Released in Apr 2019 (6 years ago). It has 959 ratings with a 4.68★ (excellent) average. Based on AppGoblin estimates, it reaches roughly 71 monthly active users . Store metadata: updated Apr 8, 2025.

Data tracking: SDKs and third-party integrations were last analyzed on Feb 8, 2025.

Store info: Last updated on App Store on Apr 8, 2025 .

4.68★

Ratings: 959

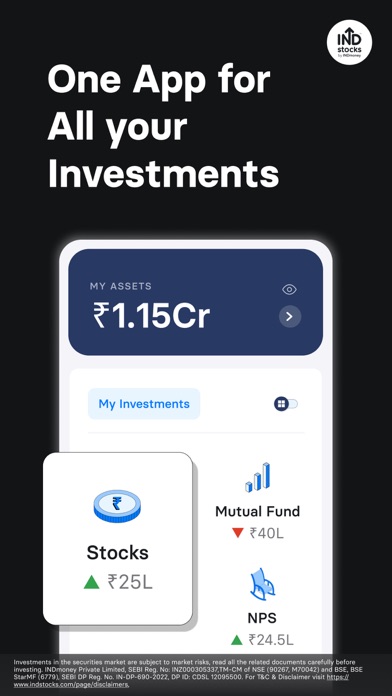

Screenshots

App Description

INDmoney: All-in-one Finance App

Track, invest & grow your money - Investment and Finance App with 1.60Cr+ trusted customers

- Key features of the INDmoney App:

• Automatically track all finances on one app

• Track all expenses, bank accounts & credit cards

• Invest in the Indian stocks & Mutual Funds with a FREE Demat Account

• Set-up SIPs for stocks, ETFs & 1600+ direct Mutual Funds

• SIP in US stocks like Apple, Google, Tesla, Nvidia & more

• Free personalized Insights & alerts on companies & markets

- Key features of investing in the Indian Share Market

• Free investment & Demat account with paperless & fast KYC

• Automate your SIP across 5000+ Stocks & 160+ ETFs

• Set up daily/weekly/monthly SIPs

• Buy & Sell Shares in 1-tap

• Invest in IPOs & Stay Updated with Upcoming IPOs

• Withdraw up to ₹1 lac from available wallet balance

• Boost Intraday Trading balance by 5x

• View PCR, OI, IV with Options Chain

• Place basket orders with 1 tap

• Access LIVE calendarized PnL

• F&O trading with automated chart patterns

- Key features of investing in US stocks

• Invest in US stocks from India starting ₹100

• Enjoy ZERO Platform fee & Withdrawal fee

• Start weekly/monthly SIPs in 5000+ global stocks

• Fast Fund Transfer to your US Stocks Wallet

• Check portfolio returns in both INR & US$

• Get calendarised PnL

• Easily track dividends with Dividend Calendar

INDpay by INDmoney - Your All-in-One Payments & UPI platform

• Send money instantly using UPI ID/contacts

• Instant UPI investments via your linked bank account

• Pay all bills fast—electricity, credit cards, mobile postpaid, gas, water & more

• Automate recurring bill payments

• Up to ₹1000 cashback on credit card bill payments

INstaCash

Unlock pre-approved credit, ready for instant disbursement to your bank account through a hassle-free digital process.

Loan amount: up to 10 lakhs

Repayment loan: 3-60 months

Annual interest rate (monthly reducing): 10.99 - 30%

Loan processing fee(PF): 2 % + GST

Note: INstaCash services are facilitated by Finzoomers Services Pvt Ltd & are available exclusively to Indian citizens within India. Interest rates are set by the lending partner and vary based on factors like credit score & customer profile.

Registered NBFCs & Banks

Kisetsu Saison Finance (India) Pvt. Ltd https://creditsaison.in/partnercontact

IDFC First Bank Ltd.https://www.idfcfirstbank.com/personal-banking/adlp/digital-lending-partners

Aditya Birla Finance Ltd.https://finance.adityabirlacapital.com/our-digital-lending-platform-partners

Privacy Policy: https://www.indmoney.com/page/instacashpp

Representative Example:

Principal